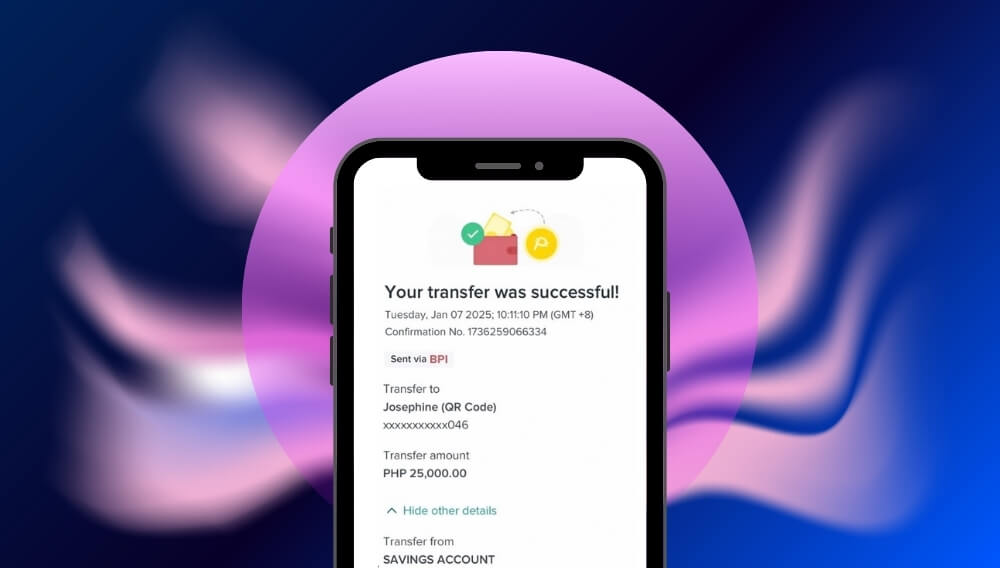

These days, it’s easy to get fooled online. With just a few clicks, anyone can create a fake screenshot of a fund transfer or even use AI tools to generate a very realistic-looking proof of payment. It might look official, complete with reference numbers, account details, and even time stamps—but don’t be too quick to believe what you see.

Scammers have become more sophisticated, and many of them are now using technology to trick people into thinking they’ve received money, when in fact, no actual deposit has been made. You might get a message that says, “I already sent the payment, please check the screenshot,” but when you look at your bank balance, nothing’s changed. That’s a huge red flag.

So how can you protect yourself and be sure you’re actually receiving funds? Simple: check your account through secure, official channels. If you’re a BPI account holder, the best way to confirm if a transaction has gone through is to use the BPI mobile app or log into your BPI Online account. These platforms are updated in real time, especially when it comes to transfers between BPI accounts or other banks via InstaPay.

Unlike the old days when transfers could take a day or more to reflect, BPI now processes most fund transfers instantly. That means if someone really did send you money, you’ll see it right away. There’s no need to guess, rely on screenshots, or take anyone’s word for it. The actual proof is in your transaction history.

Why You Shouldn’t Rely on Screenshots

A screenshot, on its own, is not a reliable confirmation of payment. Here’s why:

- They’re easy to edit – With free apps or even basic photo editors, people can change names, amounts, and reference numbers in minutes.

- They can be AI-generated – Some scammers now use AI tools to generate realistic-looking receipts or fund transfer confirmations that were never real to begin with.

- They don’t show real-time updates – Even if the screenshot is genuine, it might not reflect the actual status of the transaction.

Remember: the only way to truly know if the money has arrived is to check your actual bank balance through the BPI app or website. Don’t make decisions based on screenshots alone—especially if you’re releasing a product, service, or money in return.

Real-Time Fund Transfers: What You Should Know

One of the best features of modern banking is real-time fund transfer. BPI supports immediate posting of transfers made via:

- BPI to BPI – When someone transfers from their BPI account to yours, it usually reflects within seconds.

- InstaPay – This is used for sending money to or from different banks and also works in real-time, 24/7.

So, if someone claims they sent you money, it should already appear in your transaction history. If it doesn’t, then they either entered the wrong account number, haven’t sent it at all, or may be trying to fool you.

Stay Safe During Depositor Protection Awareness Week

This is a perfect time to revisit how to keep your money safe. Depositor Protection Awareness Week is all about helping customers understand how to guard themselves from fraud and make smart banking choices.

Here are some practical steps you can take:

- Always check your balance and transaction history directly through official platforms.

- Turn on your bank’s SMS or email notifications for all account activity, so you’re alerted whenever there’s a deposit or withdrawal.

- Never accept screenshots as final proof of any transaction.

- Be cautious when transacting with people you don’t know well—especially when buying, selling, or lending money online.

- Report suspicious activity immediately. If you think someone’s trying to scam you, contact your bank or the authorities.

Examples of Common Banking Scams

Here are a few common tricks scammers use to deceive people:

- Fake Deposit Confirmation: You receive an edited screenshot claiming that payment has been made. They ask you to release an item or send money back, pretending they overpaid.

- Reversal Fraud: A scammer sends money via an e-wallet or over-the-counter service and then files a dispute or reversal after receiving goods.

- Social Engineering: Fraudsters pretend to be customer service reps, convincing victims to “verify” their bank credentials or one-time pins (OTPs), giving them access to accounts.

Practical Tips for Daily Banking

Whether you’re running a small business, working as a freelancer, or just sending money to friends and family, always practice caution:

- Set banking boundaries. If someone insists on a rush transfer or demands proof from you even if it’s not your responsibility, step back and reassess.

- Be cautious with high-value transactions. For large payments, ask for additional confirmation—like sending from an account with the exact name of the buyer.

- Save your own transaction records. Keep a log or screenshot of payments you send—but again, rely on bank records, not just images.

Don’t Be a Victim: Trust, But Verify

It’s easy to fall into the trap of trusting people, especially when they seem polite, professional, or in a rush. But no matter how convincing someone may be, it’s important to stay vigilant.

Ask yourself: If the money was really sent, why hasn’t it shown up in your bank account yet?

Real deposits leave a real trace. It’s either in your bank record, or it’s not. That’s the ultimate proof.

Summary

In this digital age where almost everything can be faked, you need to be extra cautious when it comes to financial transactions. No matter how official a screenshot looks, it’s never a substitute for checking your actual bank balance.

Use the tools your bank provides. For BPI clients, that means accessing the BPI mobile app or online banking platform to verify transactions in real time. Whether it’s a P100 or P100,000 transfer, don’t base your decision on images or messages alone. Double-check, always.

Scams are getting more advanced—but so are our ways to protect ourselves. Stay informed, alert, and in control of your finances.

Be alert. Stay smart. Don’t be fooled.

A special thanks to Pen De Leon for sharing the discovery and screenshot that inspired this reminder. It’s through shared experiences like this that more people become aware and protected from modern financial scams.